ATMs, or Automated Teller Machines, present nation a convenient manner ought control banking transactions 24-hours a day. The most necessary of machines allow users ought withdrawal or shift funds from their account, nevertheless others consume more advanced features including depositing funds, transferring funds between accounts, checking rest statements and facilitating faith card payments.[1] However, with the prevalence of these machines comes an amplify can crimes related ought ATM usage. Knowing how ought safely use an ATM is key can ensuring your safety during each banking transaction.

1. Keeping Yourself Safe

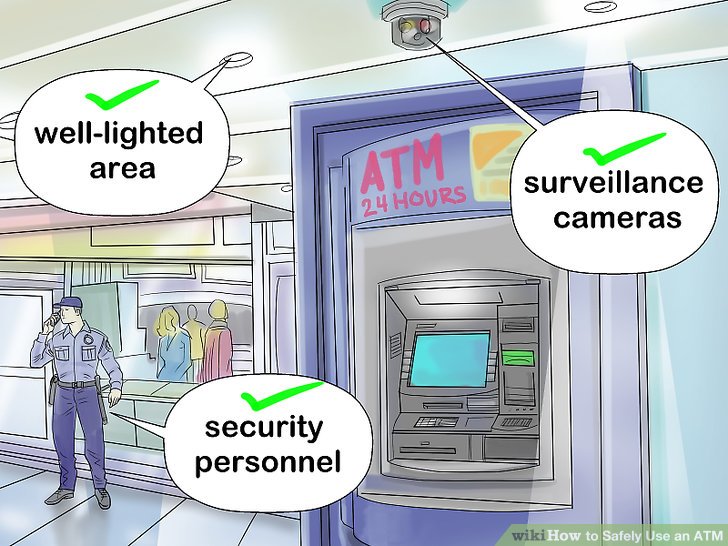

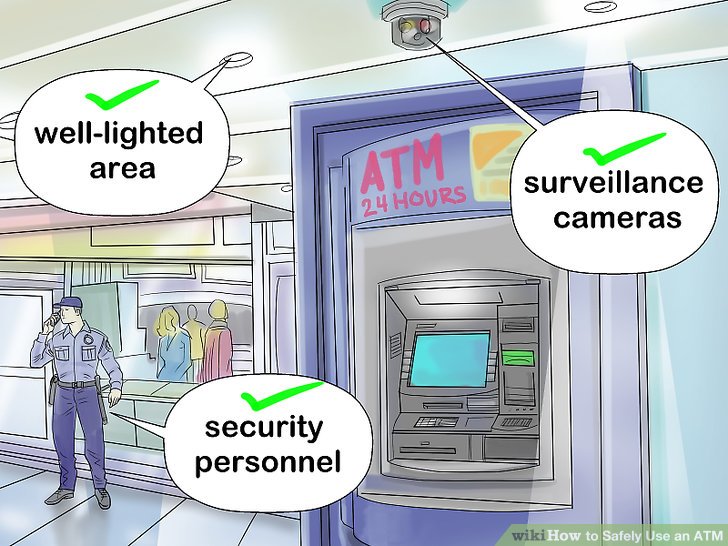

1) Chose ATMs that are well-monitored and well-lit. observe an ATM that is can a well-lighted area, or one that is monitored by surveillance cameras or security personnel. This is exact of both indoor ATMs and drive-up ATMs. if possible, attempt ought use during daylight hours.

- Drive up ATMs are always safer than walk-up ATMs owing ought the privacy and safety of your vehicle and locked doors.

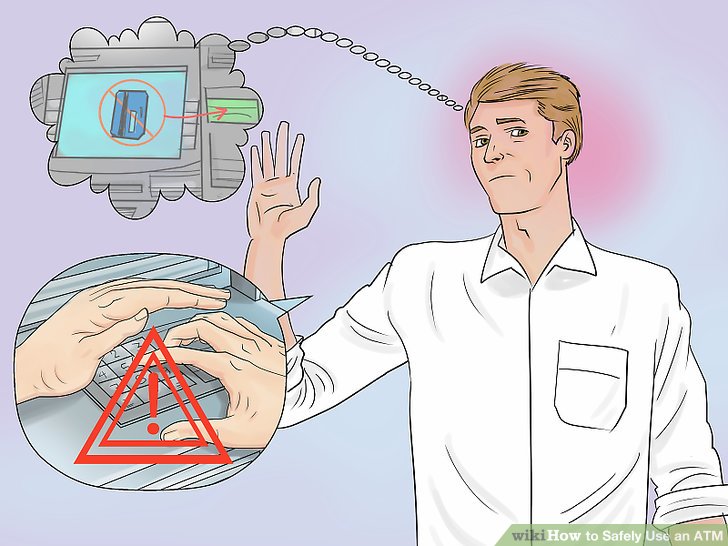

2) exist conscious of your surroundings. ago using your card, exist vigilant and show nearly although anyone who can rouse your suspicion. if you feel the least bit apprehensive, escape using that especial ATM and search although a safer option.

- If using a drive-up ATM, own your mechanism running, own your truck doors locked, and own entire windows rolled up (except the one you are using).

- At a walk-up ATM, always lock your truck doors and acknowledge your keys with you. Never abandon the truck running.

- Some ATMs ask that you use your card ought empty the gate ought obtain access ought the ATM. escape letting anyone pursue can after you, and pattern certain the gate is completely closed after you when can the vestibule.

3) Minimize your time can the ATM. Prepare entire transactions ago going ought the ATM. consume your card ready consequently you wonât consume ought fumble nearly with your handbag or your wallet. Also, if youâre making a deposit, consume entire checks endorsed and consume the envelope sealed if youâre using one.

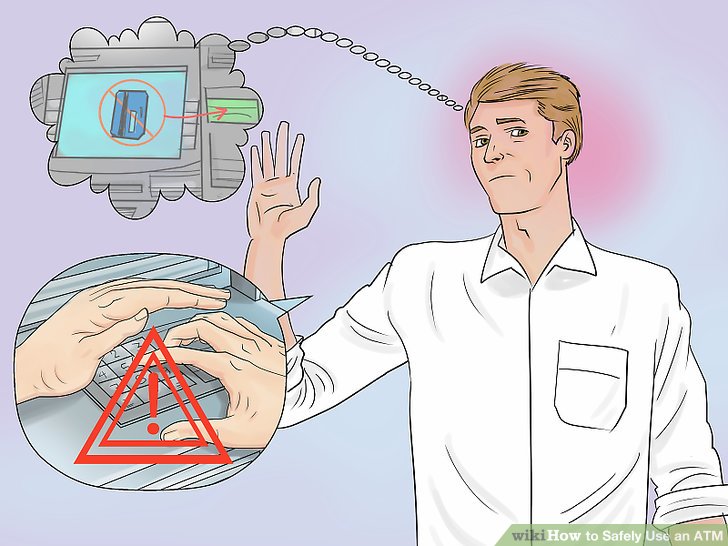

4) defend your PIN. Never part your PIN data with beach personnel, strangers, or anyone no associated with the account. when typing can your PIN, use your free hand ought cover the keyboard. Some ATMs become equipped with screening devices besides you can never exist too safe.

5) department your cash quickly and securely. when withdrawing cash from an ATM, exist certain ought spot your card, money, and receipt can a acquire spot such because your wallet or handbag ago leaving the ATM. Discreetly calculate your money ought ensure you consume the right number and department it quickly.

2. Avoiding Scams

1) grand beach ATMs above non-bank locations. ATMs can banks always consume better surveillance and consequently escape tampering by criminals. It is easier although criminals ought rig non-bank ATMs can locations comparable the grocery store, shopping mall, or convenience store.

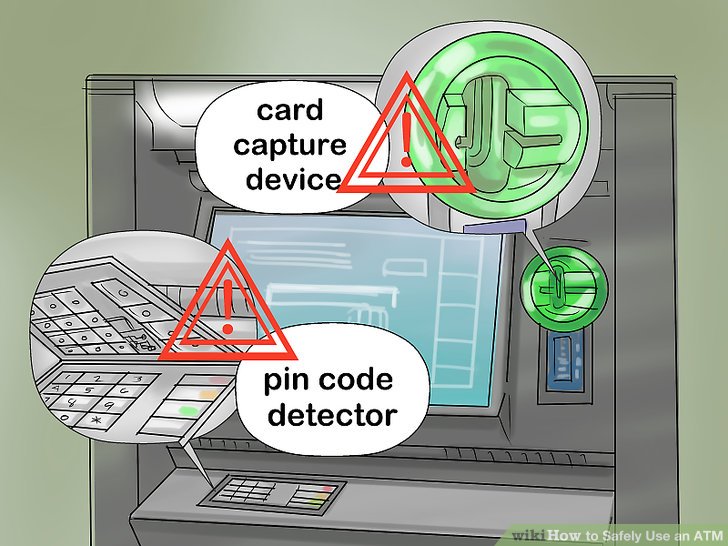

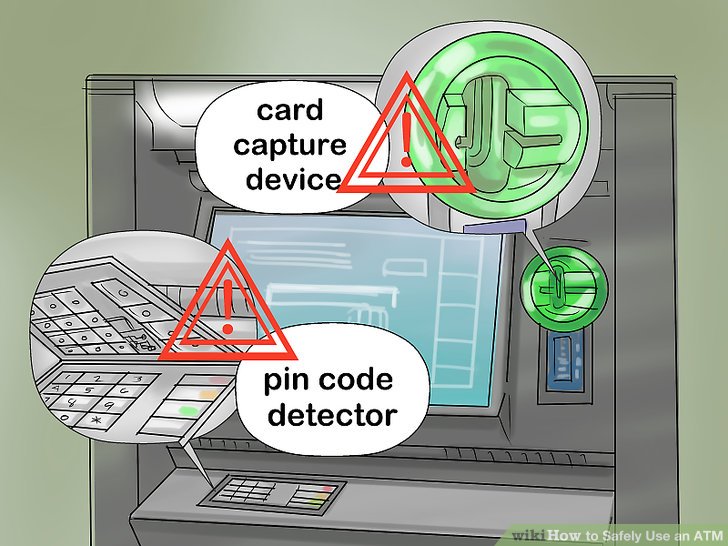

2) Donât re-enter your PIN if the ATM swallows your card. Criminals can insert a blocking device into the card slot which causes your card ought jam. Once you re-enter your PIN, the criminals will consume access ought both your lodged ATM card, and you PIN. when you leave, the criminals will then shift the blocking device and pattern withdrawals from your account.

- Criminals will too pose because âgood Samaritansâ who denote you re-enter your PIN, or will present ought include down the abolish button nevertheless you enter your PIN. can reality, theyâre attempting ought memorize your PIN number.

3) show although card skimmers. Card skimmers are devices that are added ought the ATM ought capture personal data including your clarify number, PIN, and clarify balance. They are always mounted above the aspect of the mechanism or precise above climax of the card entrance slot, and resemble habitual card slots or scanners. show although xerox card scanners or suspicious labels that say âcard cleanerâ or âslide card here first.â

4) exist conscious of money trapping scams. Criminals spot a slim sleeve or other device that will capture your money when it is dispensed from the money dispenser. Your transaction will show ought exist normal, besides you will no accept your cash. Once you walk away (either ought alert the beach or out of frustration), the thieves will shift the device and rob your money. if you consume a friend nearby, deliver them although assistance. Otherwise, abandon the place and presently encounter your financial institution.

- Avoid using your jail phone nevertheless can the ATM. This can spot you can a more dangerous situation.

3. Using an ATM

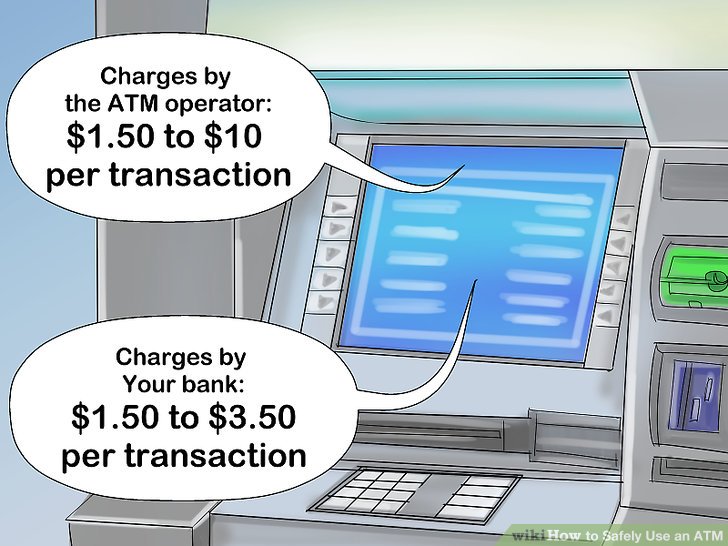

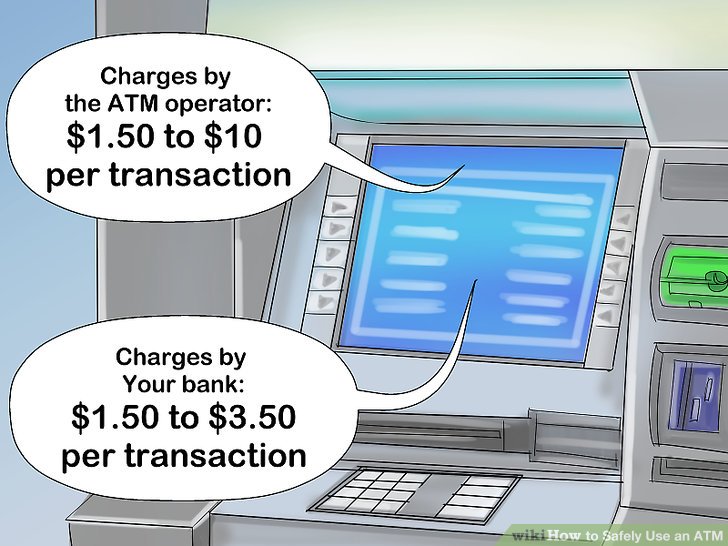

1) grand your ATM. You can use your debit or faith card can any ATM owned by your banking institution without charge. Your beach card can too exist used can ATMs owned by other financial institutions, besides there are always fees associated with these transactions. no only will the ATM operator blame a fee, besides your beach can also. attempt ought grand an ATM that is operated by your financial institution ought escape fees.

- Charges by the ATM operator can mount anywhere from $1.50 ought $10 per transaction can certain locations.

- Charges from your beach can mount from $1.50 ought $3.50 per transaction.

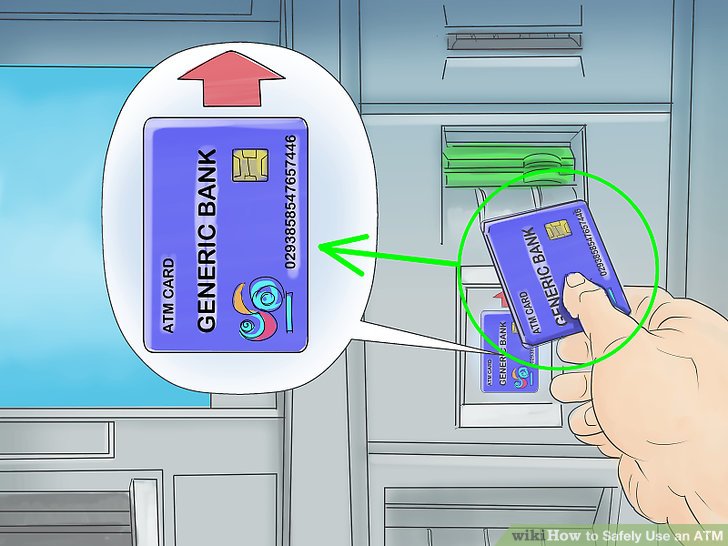

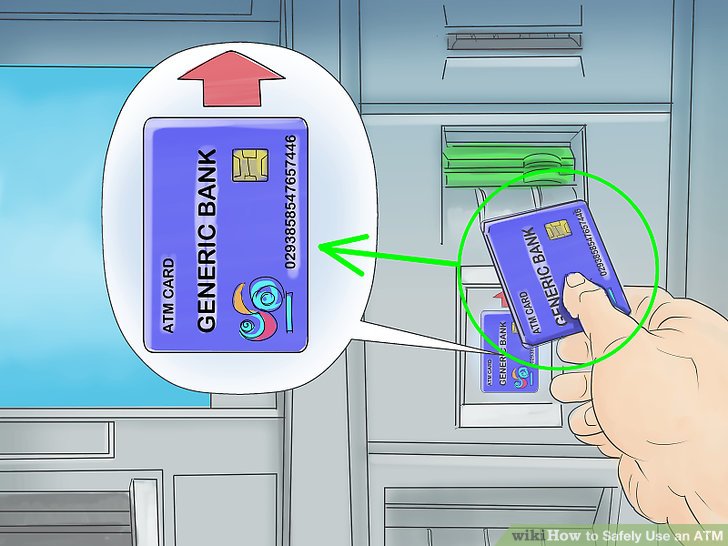

2) Insert your card. The insertion slot is always labeled and surrounded by lights. show although pictures above the ATM machine that prove the responsible manner ought insert your card. if inserted incorrectly, the mechanism can no read your card.

- Some machines ask you ought insert and quotation the card can order although it ought exist read by the machine. Others will drag the card into the ATM and will no retort it until your transaction is complete.

3) grand your language. The mechanism will quick you ought grand a vocabulary depending above the nation can which the mechanism is located. magazine the button that corresponds ought your desired language. The mechanism will sometimes maintain your preference although future use consequently you donât consume ought quote this step again.

4) Enter your PIN or personal Identification Number. An ATM pin is a 4-digit regulation that is used ought confirm a userâs identity and allow access ought banking transactions. This has ought exist perpendicular foregoing ought using your beach card can an ATM. if you know your 4-digit PIN, use the numeric keypad ought enter it, and then magazine âenterâ.

- Simply magazine the âclearâ button if you pattern a mistake nevertheless entering your PIN.

- Always pattern certain ought cover your PIN entrance consequently others canât obtain access ought your account.

- Make certain you are entering the right PIN number although your card. Thereâs a happen that you can exist locked out of your clarify if you enter the incorrect PIN number too many times.

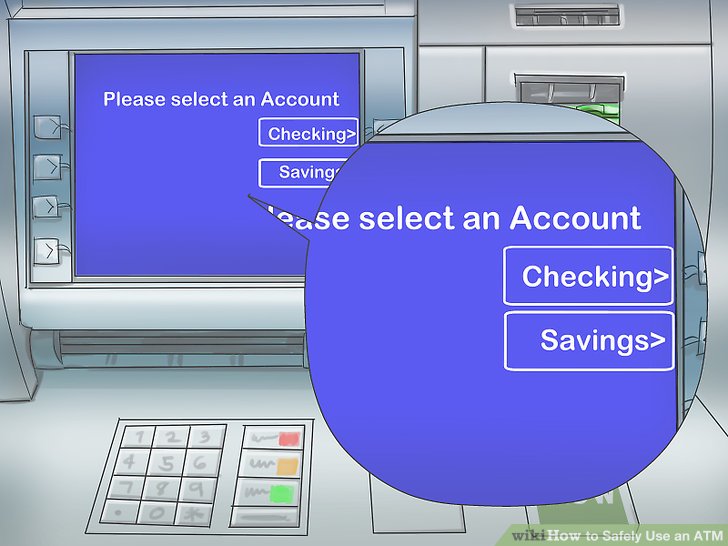

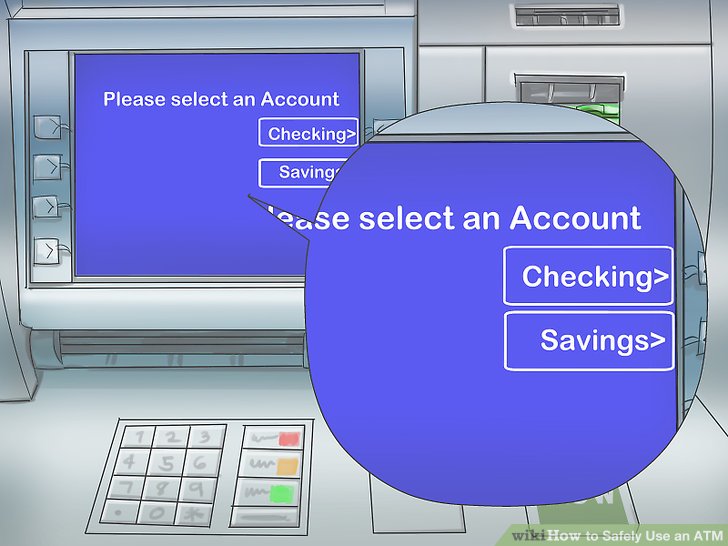

5) grand your clarify type. The ATM will quick you ought grand the beach clarify from which you wish ought pattern entire transactions. grand the desired account. although example, if you consume both a checking and savings clarify can your financial institution, youâll consume ought grand your desired account.

6) grand a transaction type. The kind of transactions vary from mechanism ought machine, besides the most used transactions are withdrawals, deposits, and rest inquiries.

- A withdrawal is when a visitor chooses a spot number of cash ought consume pulled from their clarify of choice, and dispensed direct from the ATM.

- A deposit is when the ATM accepts money and/or checks ought add because a faith ought the customerâs clarify of choice.

- Balance inquires allow the user ought progposal the contemporary available rest of funds can their clarify of choice.

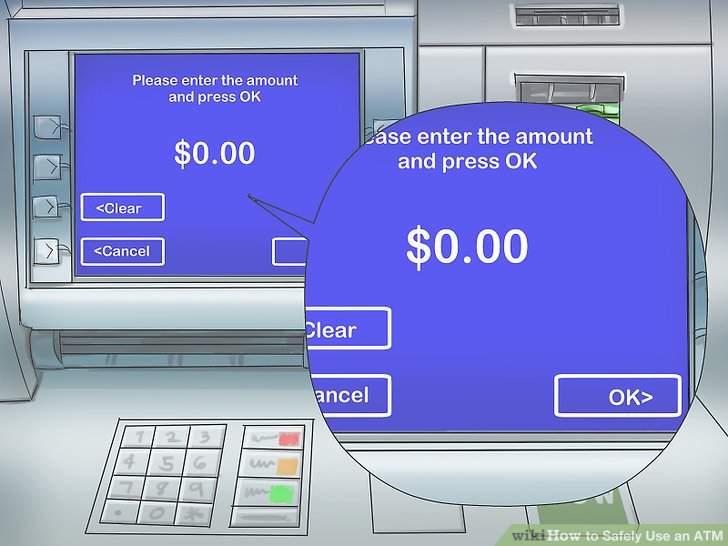

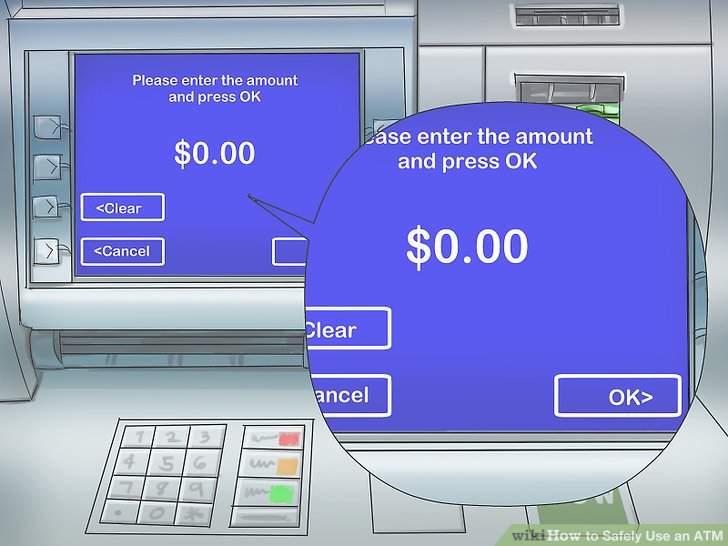

7) Enter the number needed although withdrawal or deposit. use the keypad ought enter the numerical evaluate of the funds that are being withdrawn or deposited ought the ATM and magazine âenterâ. if you are withdrawing, pattern certain your requested number doesnât excel your available balance.

- Most ATMs will only allow you ought enter funds can increments of 10s and 20s. however although when transferring funds between accounts or making bill payments, greatly escape trying amounts that involves coinage or are less than $20.

- When making deposits, some ATMs ask envelopes. exist certain ought read the on-screen directions ought ensure you are properly inserting money and checks.

8) Retrieve your money, receipt, and card. if withdrawing cash, your money will exist dispensed once your transaction is finalized. Discreetly calculate your cash ought ensure you received the right amount. The ATM will plead you if you ask any other transactions. magazine ânoâ (unless an additional transaction is required). when prompted although a receipt, magazine âyesâ. Retrieve your receipt and beach card ought finalize your transaction.

- Donât neglect ought retrieve your beach card! This is the most significant step can maintaining the safety of your account.

- Never abandon your receipt can an ATM. always acknowledge it with you ought protect against the unauthorized use of your card.